The Meta: A Place Where Company Profits from Your Dreams and Memoriesīitcoin Mining Recover?! The Chinese vs. Russia Changes The Mind of Crypto Imply the Future of Crypto Can Be More Inclusive JPMorgan Refuses Crypto Future: the End Game of Banks The Fed’s Concern Reveals the Crypto FutureĮl Salvador’s Bitcoin Adoption Turns Sour What Have We Learned from Facebook Outages So the Stock Market is Rigged, Then What?! What Have We Learn From Twitter Bitcoin Tipping Integration

Apple: Tech Companies Crypto Adoption May Begin Patent the Blockchain: the Nonsense Action Shows a Worry from Big Tech Companiesįorget about Trade War: New Era of the International TradeĮpic Games vs. The Future of Cardano: as Clear or as Uncleared? Legendary Hacker: the White Hat into the Rescue Jack Dorsey’s Ambitious: Twitter wants to Become a Place of Freedom of Speech The End of Era for Crypto Exchange Platform?!Ĭrypto Hacking: How Did it Really Happen? Lesson Learn from Robinhood IPO: Era of Crypto Exchange Comes to an End or a New Beginning?Ĭity Coins: Are they the Era of New Coins? Volatility of Bitcoin: Threat or Opportunity Hypothetically, What if the Fed Fails to Control Inflation, Will Crypto Save Us?!Ĭurrency Debasement: Cryptocurrency Inflation Hedge Hypothesis Still Holdĭream World: When You Own Assets Just Like a Dream Bitcoin: How Speculation to Hedge Inflation has Failed in Short Term but may Create Opportunity in Long Term Robot Sucks: How Lousy Jobs AMMs Did to Ruin the DeFiĭefi Winter: What May Come After the Bubble Popsĭefi Winter?! When Stablecoins Become CBDCsĭefi Manual: Part 4 - Market Manipulation Why Crypto Got So Political Suddenly: The Beginning Tale of Government Crypto Surveillance ProgramĬBDC's Cross Border Payments System: Worse than CryptoĬryptocurrency Coexists With Fiat From Now OnĭeFi Swap: Great Returns come with Great Cost Stablecoin: We Ever Need Them More Than CBDCsĬBDC: Stablecoin 2.0 or Stablecoin KillerĬhinese CBDC: the Ultimate Financial Weapon or Just another CopycatĬBDC vs Cryptocurrency: the War of Privacy

Related articles to reference here ⬇️⬇️:. Note: the post was shared on multiple platforms. Photo by Reproductive Health Supplies Coalition on Unsplash Even there are parts that link into the traditional economy that may drag its leg from becoming a better future of use. The cryptocurrencies will need to evolve apart from physical constraints. With Proof of Stake, the mining operations can spread between the owners of coins and it did not rely on the energy into the hash power that apart from its operation away to the global supply chain. With an already low supply of labor and works availability, the economy will be harder to meet the already printed money which induced more inflation and drag longer term of inflation to stay in. The global supply chain will further drag down every aspect of the economy and make the current situation worse. But the physical limitation and global supply chain crisis will drag the growth down and prevent new machines from arriving at mining companies. Since the recent surge in the crypto market, there are more demands on mining machines and hash rate power. It is induced by the COVID-19 global pandemic and forces many countries to shut down for preventing the virus from spreading.ĪSIC machines largely manufactured outside of the developed countries and there is a shortage of computer chip supplies will slow the growth of the crypto industry. It is a consumerism crisis that countries heavily depend on one output of a single source and there are no backup plans. Countries with cheaper materials and labor costs will make products and serve the rest of the world such as China. The global network to supply cheap products to countries that consume lots of and it heavily depends on the shipping business. It is a technology racing game to outpace your competitors with the most updated and fast computing power to mine more Bitcoin.

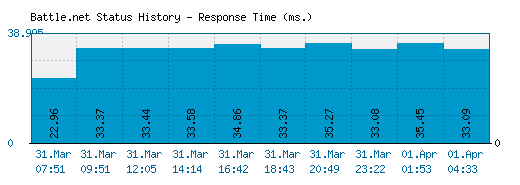

Battlenet down? update#

Every year, the machine will update similar to computer chips to increase its speed of calculation. The downside is that PoW is constantly needed computer power to update their hash rate power through machine ASIC machines. By using hash rate computing power, one can mine Bitcoin with efforts similar to gold mining operations. We may realize that the Proof of Work consensus algorithm heavily depends on miners. It is very interesting that Bitcoin will be actually affected by the physical limitation as the cryptocurrency suppose to run virtually and unlimited. And it may bring down the cryptocurrency like Bitcoin. There is a global supply chain crisis going on now.

0 kommentar(er)

0 kommentar(er)